Here’s why.

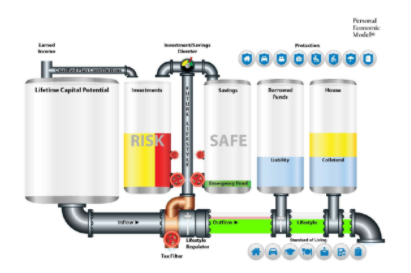

Each and every dollar that is allowed to flow through to your Current Lifestyle is consumed and gone forever. The goal is to accumulate enough money in the Savings and Investment tanks so that by the time you retire, the dollars in those tanks can then be used to satisfy your future lifestyle requirements. Position A would be to have enough in the tanks to live like you live today adjusted for inflation and have your money last at least to your life expectancy. That’s a win, but the icing on the cake would be to accomplish that with little to no impact on your present standard of living, and that is exactly what we strive to help our clients to do.

In working together, we can help you to address the following:

Optimize the balance between your Current and Future Lifestyles

Improve efficiency in your current personal economic model

Design, implement, and execute a plan to secure your financial future

Limit the impact on your Current Lifestyle dollars (maintain your current standard of living)

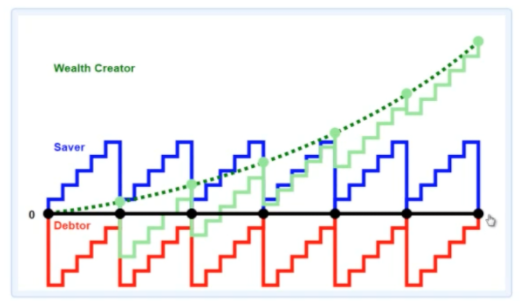

The Saver

The Saver, being well aware of the wealth transfers inherent in borrowing at interest, will postpone a purchase until they have saved enough to pay cash in full, up front. However, at the same time they make a purchase they also consume their savings and move back toward that zero line. A very precarious position indeed. A single unforeseen circumstance could lead to depleting their savings bringing them closer to the zero line. The saver constantly moves from having access to money and needing to save to get back to where they were before they had to spend their savings. They do not like to pay interest so the drain their accounts and kill compounding each time they do.

Paying cash seems to be the best way to pay for things because it avoids the necessity to pay interest but to pay cash you must also give up the ability to earn interest on those same dollars.

Another problem with paying cash is that first, you must save it which is not necessarily an easy thing to do. Depending on where you are saving those dollars, the government may also require that you pay taxes on the growth of that money. And when you do make a purchase not only do you consume those savings, but you also negate the ability of those dollars to earn interest because they have been spent. Many people choose to pay cash in order to avoid paying interest to a lender, which seems smart. However, the part that is often missed is that they are also losing interest they could have earned had they not had to pull dollars out of the account to make a purchase in the first place. But it’s not possible to keep the dollars in the account earning interest and still make the purchase, is it?

The Wealth Creator

The Wealth Creator utilizes a unique approach. They also save, but when it is time to make a purchase they use their savings as collateral to secure a loan, preferably at a lower interest rate than they are earning on their money.. Now, there are a couple of key benefits here. The first is that this strategy keeps you from having to deplete your savings to make a purchase. At the same time, it allows those savings to continue to compound interest without interruption. Secondly, while the Wealth Creator does pay interest on the loan, they can often do so at negotiated rates. As the loan is repaid, the amount of savings available to be collateralized increases proportionately until the loan obligation is met. Compound interest works best over time uninterrupted. Resetting compounding on dollars we remove from accounts that are earning interest is not an efficient purchasing strategy.

We all want to make the most of the resources available to us; to be as efficient as we can be while also avoiding wealth transfers. Once a decision has been made to part with our dollars, it is permanent. Since we can never have those dollars back again, it makes sense to spend them wisely. To spend them in a way that fosters the creation of wealth, not the relinquishing of it. Let’s spend some time together to discuss how we might improve your purchasing efficiency.